- OT

- Industry

- Equipment and suppliers

- A growing domiciliary demand

A growing domiciliary demand

Henry Pitman, chairman of Optimism Health Group, tells OT about the demographic changes creating opportunities for domiciliary, and some of the hurdles to growth

03 February 2022

We started to build our healthcare investment business, Optimism Health Group, at the beginning of 2020, and spent the first six months of the year researching healthcare sectors. We became particularly interested in providing clinical products and services to the older demographic.

Optimism Health Group

There is a lot of investment in care homes and live-in care, but some of the periphery, niche services that are essential for people in their own homes, such as the domiciliary sector, have been overlooked. Without question, the domiciliary sector has had a challenging time during COVID-19. Having said that, we think the pandemic has shone a spotlight on the provision of healthcare services at home.

Our lives have fundamentally changed during COVID-19. We are all used to services and products coming to our home. There is a growth in people wanting to be served at home – whether it’s an Amazon parcel, Uber Eats, or having their hairdresser coming around.

Care homes have had an extremely challenging COVID-19 and are now rebuilding. For many, there hasn’t really been the provision of eye care and hearing care during this period, so we are focused on building our capacity to be able to increase the number of care homes we can support. There is a huge demand for eye care in care homes and also a massive shortage of audiology provision.

A constraint on the growth of domiciliary has been a lack of awareness. The idea that you can have a clinician providing one-to-one treatment for an hour in your own home is an extraordinary service. But I think that it is a niche sector that most of the general public haven’t come across.

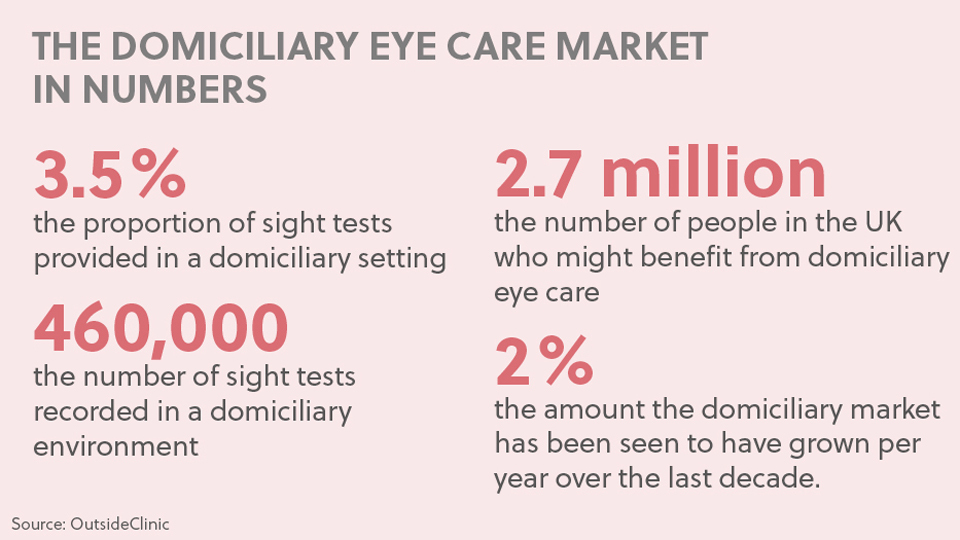

We believe there is an opportunity to significantly grow the size of the domiciliary market. At the moment it is about 3.5% of overall sight tests. Around 460,000 sight tests are recorded in a domiciliary setting.

Our research suggests that there are about 2.7 million people in the country who would benefit from domiciliary eye care. The majority of those people either don’t know about domiciliary eye care, or there is not enough provision in their area.

The growth in domiciliary has been around 2% a year over the last decade. We think we can be one of the companies that helps to increase that growth to closer to 5% a year.

The power of partnerships

A major goal of the OutsideClinic’s is increasing patient awareness. We want to turn OutsideClinic into a household name.

Partnerships will become increasingly important. We want to become a domiciliary partner to High Street optometrists and we have some initiatives in that direction. In the past we have worked closely with major charities supporting elderly people, such as Age Concern, and we will be expanding those partnerships. We’re also working hard to establish relationships with live-in care providers, who look after nearly one million patients across the country.

We want to support the NHS and we are forging relationships with GPs and primary care to provide services within their communities.

The biggest challenge is recruitment. There is a supply and demand mismatch in the sector, where there is growing demand for optometry services, but a shortage of optometrists. It is a very challenging recruitment market and this is limiting growth for domiciliary.

However, we are finding that we are able to attract practitioners to domiciliary, which has a number of advantages. We are working hard to try to create an environment where people find OutsideClinic an attractive place to work, with the flexibility that a modern workforce requires. Following COVID-19, we have found that our optometrists are no longer looking for the nine-to-five, five days a week. They are seeking a different type of working contract.

We think that domiciliary is going to be the fastest growing area of optometry over the next five to 10 years

There is an issue with workforce planning in the sector. It doesn’t seem that the Government is thinking far enough ahead in anticipating the future demand for optometrists. Not enough university places are being created and domiciliary has not been taught properly. We find that optometrists tend to be concentrated in certain parts of the country, which is generally where the universities are. While we find it relatively straightforward to recruit in some of the big metropolitan areas, it is almost impossible to recruit in some of the overlooked rural areas.

We would call for much better provision of optometry training and university places in overlooked areas to get a better spread of optometry skills across the country.

I think there are a lot of patients out there simply not being supported at the moment, which has serious repercussions. If people can see and hear well, then they are much less likely to have falls, it will slow down the onset of dementia. There are huge health advantages for people in having this kind of support, and it takes pressure off the NHS.

We expect that domiciliary is going to be the fastest growing area of optometry over the next five to 10 years. Optometrists have the opportunity to engage in their local communities, and to get to know and support some of the most vulnerable people in society.

Attracting professionals into domiciliary

Henry Pitman discusses the appeals drawing optometrists into domiciliary

“From a professional perspective, domiciliary eye care provides an interesting variety of work. Optometrists see elderly patients with a range of different issues so it is a challenging and rewarding place to be.

“We find that the people who work for us love the freedom they have in moving around the countryside, visiting people in their homes, spending quality time, and really getting to know their patients.”

“It does have its challenges, but many find it an incredibly worthwhile job. The working hours of domiciliary also give people an opportunity to have a better balance between work and family life, as there is no weekend working.

“We are looking at creating the OutsideClinic Academy, which is going to support optometrists with their training and CPD. This will also act as a way to introduce High Street optometrists to the benefits of domiciliary, because we feel that offering people the opportunity to experience a conversion course into domiciliary is a powerful benefit that we can offer the sector.”

In 2021, OutsideClinic launched its largest ever recruitment drive, seeking to appoint optometrists to its team across the UK.

Optimism Health Group has recently announced that OutsideClinic acquired Care Opticians and launched a new joint venture model. To read more about the acquisition, read OT’s news story here.

Advertisement

Comments (1)

You must be logged in to join the discussion. Log in

Frank Eperjesi04 February 2022

I work in domiciliary eye care and it is very rewarding. I find I can make a huge impact on the quality of life of very poorly people. It's no fun being stuck inside but it's even less fun if you can't see well. I can help people read and see the TV better. It is hard work but the people are extremely grateful and it's what I trained for.

Report Like 324